Having a financial plan of action is absolutely necessary for every company; learn precisely why by reading this article.

Within the competitive business arena, the importance of business finance is something which comes up over and over again. When managing your business finances, among the most essential things to do is take note of your company cash flow. Primarily, what is cash flow? To put it simply, cash flow describes the money that moves in to and out of your business over a particular period of time. In other copyright, cash comes into the business as 'income' from customers and customers that get your products and services, but it flows out of the business in the form of 'expenditure', such as rent, incomes, month-to-month loan payments and payments to suppliers, and so on. One of the biggest challenges that a company can deal with is experiencing a negative cash flow, which is where more cash is moving out of your business than what is going in. This is not always a business-ending circumstance, as long as it is just momentary and the business is able to rebound reasonably rapidly. Since cash flow is so crucial, one of the greatest suggestions is to keep track of your company cashflow on a weekly or monthly basis, typically through financial evaluations and reports. Routinely tracking cash flow and precisely reporting it is one of the primary foundations to developing financial propriety, as shown by the UK financial services market.

As an entrepreneur, . having some key strategies for effective financial management is absolutely fundamental. It is something that should be one of the very first concerns when setting up a business enterprise, as presented by the France financial services sector. In addition, one of the greatest financial management practices examples is to learn exactly how to budget plan effectively. Doing the appropriate research and putting together a reasonable and practical budget plan is a great starting point for any kind of business. In the very early days of company, it is easy to get carried away with the spending; having a budget is a good way to remain on track and not be too careless with non-essential expenses. When you get into the habit of budgeting, you ought to likewise begin putting aside some savings into an emergency fund. With markets continuously going up and down and consumer needs transforming, setting up a business can be a costly and high-risk move. By having some emergency funds to fall-back on, it takes some of the pressure off and offers a small amount of security.

When it pertains to launching a business, there are several different things to arrange at one time. Nonetheless, out of the multiple things to juggle, the financial facet of the business is arguably the most essential thing to prioritise. As a business owner, it is your responsibility to understand exactly how to manage business finances in a manner which is honest, logical and legitimate. Among the best ways of managing business finances is to keep the business finances and individual finances as separate as feasible. Maintaining a clear separation between your own personal and business finances is vital, specifically since blurring the line between the various financial resources can create confusion and in severe cases, lawful complications. As a new company owner, the very last thing you want to do is possibly tangle yourself up in any legal issues, especially because financial propriety is the cornerstone of a successful business, as seen with the practices supported by the Malta financial services sector and comparable entities.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Matilda Ledger Then & Now!

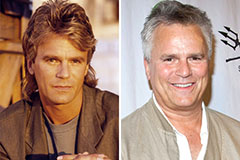

Matilda Ledger Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!